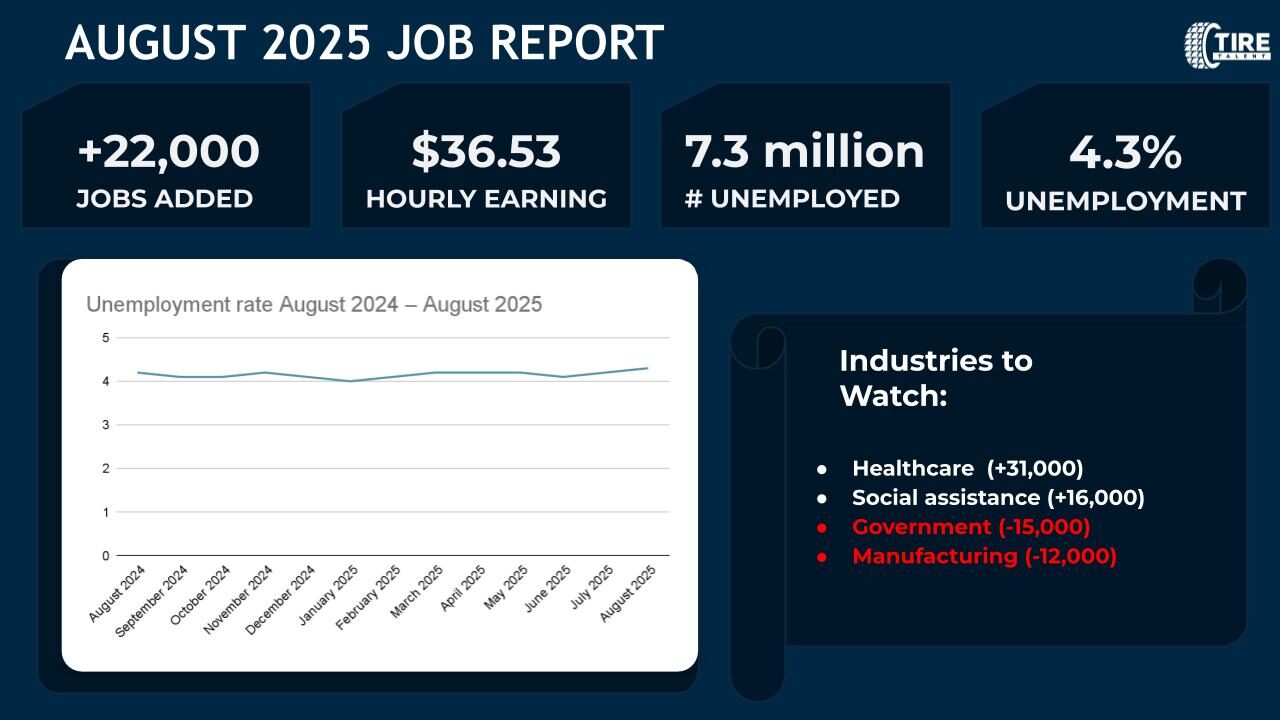

The tire and automotive job market in the U.S. is moving faster than most hiring teams can keep up with. Electrification and hybrids, ADAS/telematics, new manufacturing tech, and tightening service SLAs are changing who you need, how quickly you must hire them, and what it costs to keep them. Meanwhile, demand for tires remains resilient, and the pipeline for technicians and manufacturing talent is still tight in many regions—pushing wages up and time-to-fill longer. Recent industry and workforce data confirms both the opportunity and the pressure for employers that need to hire right, hire fast, and retain.

Below, you’ll find a practical, data-anchored briefing and a step-by-step hiring playbook built for plant leaders, aftersales directors, HR/TA teams, and multi-store service operators.

1) Market snapshot: demand is resilient, skills are shifting

- Tire demand remains strong. USTMA projects U.S. tire shipments to rise to ~340.4M units in 2025, up from 337.3M in 2024—surpassing prior records. For plant staffing and logistics, that signals stable to rising throughput needs, not contraction.

- Economic footprint is significant.U.S. tire manufacturing supports ~78k direct manufacturing jobs and hundreds of thousands more across the supply chain—evidence that talent competition will stay local and persistent around major hubs.

- Electrification is real—but nuanced.EVs reached about 10% of U.S. light-duty sales in 2024, indicating a steady (not uniform) shift in product and service mix. Even where all-EV growth pauses, hybrid adoption and advanced electronics continue to reshape required skills in service bays and factories.

- Techs remain in short supply. The transportation technician workforce grew in 2024, but the gap between demand and supply still strains hiring pipelines, especially for diagnostics, ADAS calibration, and high-voltage skills.

What this means: Employers who recalibrate competency models (electrical, software, data) while strengthening recruiting and retention fundamentals will outperform on uptime, quality, and customer experience.

2) Where the jobs are (and what they pay)

Even within the same plant or network, the mix of roles and wages varies widely.

- Manufacturing roles. Classic roles (tire builders, curing press operators, maintenance, quality) now compete against advanced manufacturing employers for similar mechatronics skill sets. BLS OES data shows tire builders as a distinct occupation within rubber product manufacturing with competitive median wages; regional variance is meaningful for setting offers and differentials.

- Aftersales & service roles. The automotive service technician/diagnostic tech path is fragmenting into high-voltage specialists, ADAS calibration techs, and software-aware diagnosticians. BLS occupation profiles and state labor portals reflect wage bands that reward certifications and diagnostic capability. Use localized wage data when planning comp to avoid slow fill times.

Hiring takeaway: Don’t benchmark pay off national averages alone; index to local labor markets and to the complexity of your fleet/vehicle mix (ICE, hybrid, EV).

3) Technology is rewriting competency models

In plants:

- More PLC, robotics, vision systems, and IoT on curing lines and mixing rooms mean maintenance now demands electro-mechanical and software troubleshooting comfort.

- Condition-based maintenance and downtime analytics reward techs who can interpret sensor data and collaborate with process engineers.

In service centers:

- High-voltage safety (isolation, PPE, lockout/tagout) and battery thermal management competence move from “nice to have” to “must have” where EV/hybrid share is material.

- ADAS calibration (static/dynamic) ties directly to customer safety and liability; documentation and QA process skills matter as much as turning wrenches.

- Connected car & telematics push technicians to interface with software tools, data logs, and OTA update workflows.

Hiring takeaway: Rewrite job descriptions to be competency-first (diagnostics, electrical/fiber, PLC/controls, data familiarity), not just tenure-based.

4) Sustainability and EHS are business drivers, not checkboxes

- End-of-life tire (ELT) stewardship is a reputational and regulatory issue. USTMA’s most recent ELT report points to sizable recovery into civil engineering, TDF, and ground rubber markets, with continued focus on safer, circular end uses. Teams that understand collection, storage, and vendor due diligence reduce risk.

- Plant EHS expectations (air quality, noise, ergonomics) plus chemical/materials transparency are shaping staffing (industrial hygienists, EHS engineers) and training norms.

Hiring takeaway: Make EHS & sustainability competencies explicit; promote your safety record and ELT practices in employer branding to win purpose-minded talent.

5) The reality of the technician & manufacturing talent gap

- Workforce growth helps—but not enough. TechForce reports a 2.8% growth in the transportation technician workforce, yet demand still outpaces supply in many metros, especially for advanced diagnostics. Employers that rely on “post and pray” will lag.

- Comp and career path clarity drive acceptance rates. Candidates weigh tool allowances, training time on the clock, and clear ladders (Tech I → Master Tech → Shop Foreman/Trainer) more than ever.

- Local pipeline is king. Proximity to community colleges and automotive programs (and your investment there) predicts fill speed and retention.

Hiring takeaway: Treat schools and military transition programs like strategic suppliers. The best pipelines are co-developed, not passively used.

6) A proven hiring playbook (built for speed & quality)

Step 1: Workforce planning you can defend

- 12-month demand model by site/store: attrition + growth + skills mix (ICE/hybrid/EV, ADAS).

- A/B role shapes: e.g., “Electrical Maintenance Tech (PLC-heavy)” vs “Mechanical Maintenance Tech (hydraulics-heavy).”

- Pay bands tied to skills ladders and credentials (ASE L3/EV, OEM certs, PLC programming, OSHA 30).

Step 2: Sourcing that actually fills roles

- Program partnerships:

- Community colleges & trade schools (co-branded cohorts; tuition assistance for a return-of-service period).

- Veterans & Guard (MOS translation to maintenance/electrical roles; fast-track interviews).

- OEM & tool vendors (scholarships, in-shop lunch-and-learns).

- Targeted media:

- Geo-fenced ads around competitor shops, technical programs, and industrial parks.

- SMS and WhatsApp follow-ups within 4 business hours of application.

- Referral machine:

- $100–$500 step bonuses at 30/90/180 days; spotlight referrers monthly.

Step 3: A selection process tuned for hands-on work

- 30-minute phone screen (safety, attitude, basics of electrical/diagnostic approach).

- Live bench test (for techs): multimeter use, read a wiring diagram, interpret a fault tree, demonstrate torque spec discipline.

- Plant/line simulation (for maintenance): simple PLC ladder logic scenario; structured problem-solving prompt.

- Structured scoring (4–6 rubric dimensions): technical, safety mindset, documentation rigor, customer/teammate communication.

- Same-day decisions where possible; offer within 48 hours of on-site.

Step 4: Compensation & perks that close candidates

- Market-indexed base with skill differentials (EV/ADAS/PLC).

- Tool allowance/stipend and paid OEM/ASE training time.

- Predictable schedules (four-10s, weekend rotations published 6–8 weeks out).

- Relocation micro-grants for hard-to-fill plants/metros.

Step 5: Onboarding that sticks

- 30/60/90 plan with a named mentor; shadowing → supervised tasks → independent work.

- Safety refreshers, EV/ADAS handling, and documentation standards in week one.

- One “quick win” project in the first 30 days to build confidence and belonging.

Step 6: Retain through growth and recognition

- Skills ladders with pay transparency; credential bonuses (ASE L1/L3, OEM ADAS, Siemens/Allen-Bradley).

- Quarterly “golden wrench/golden hardhat” awards linked to KPIs (first-time fix rate, MTTR/uptime, quality escapes).

- Up-or-out leadership pipeline: lead techs and line leads trained in coaching and CI (5S, A3).

7) Rewriting job descriptions for the new reality (copy-and-apply)

Don’t lead with tenure. Lead with outcomes and competencies.

Example: Maintenance Technician (Tire Manufacturing, PLC-Focused)

- Outcomes: Reduce unscheduled downtime by 15% YoY; sustain OEE ≥ 85%.

- Core competencies: PLC troubleshooting (Allen-Bradley), VFDs, industrial networking basics, IR thermography, precision alignment.

- Safety: LOTO mastery, arc-flash awareness, chemical handling.

- Must haves: Prior high-volume manufacturing; able to read P&IDs and ladder logic; CMMS fluency.

- Nice to haves: Vision systems, cobot experience, root-cause analysis (5-Why, Fishbone).

- Growth path: Senior Tech → Reliability Tech → Maintenance Supervisor.

Example: Diagnostic/EV Technician (Service Network)

- Outcomes: First-time fix rate ≥ 90%; average cycle time < 24 hours for non-parts jobs.

- Core competencies: High-voltage safety, CAN bus diagnostics, ADAS calibration procedures, service info systems.

- Certs: ASE A6/A8, L3 preferred; OEM EV certifications a plus.

- Customer standards: Clear notes, photo/video documentation, callback ownership.

- Growth path: Master Tech → Shop Foreman → Technical Trainer.

8) Training & upskilling that pay for themselves

- Plant maintenance academy: 6–8 week blended modules (electrical fundamentals, PLC intro, vibration analysis, CMMS). Measure ROI by MTTR and unplanned downtime trend.

- Service tech academy: monthly EV/ADAS refreshers, OEM-aligned procedures, and a documentation clinic to lift first-time fix rates.

- Cross-training: rotate quality and production techs through maintenance “ride-alongs”; build bench depth for vacation/leave seasons.

- Micro-credentials: badge system in your HRIS/LMS; tie to skill differentials to motivate learning.

9) Employer brand: why a candidate should pick you (not the other guys)

In a tight market, how you present often wins the final yes:

- Safety & stability: publish your record and what you invest annually in PPE, tools, and training.

- Modern tech stack: advertise your diagnostic gear, calibration lanes, robotics, CMMS—signal growth, not stagnation.

- Career ladders: show real examples of techs who became supervisors or engineers.

- Community & benefits: tuition help, tool programs, shift predictability, and relocation micro-grants.

Turn these into assets: 60-second facility tours, day-in-the-life clips, and before/after turnaround stories.

10) Compliance, safety, and documentation aren’t paperwork—they’re retention

- Clear SOPs and documented workflows reduce stress and rework—techs stay where they can do great work safely.

- EV/ADAS procedures and tooling ensure quality and protect against liability (a major concern for experienced candidates).

- Auditable training records double as development plans—good for inspections, better for morale.

11) Capacity planning for seasonal spikes

- Service peaks: snowbelt tire changeover, summer road trips, and back-to-school checks.

- Plant peaks: new model launches, distribution pushes, and preventive maintenance windows.

Build reserve capacity through flexible staffing, overtime strategies with clear guardrails, and pre-qualified contractors.

12) Metrics that tell you your hiring strategy is working

Track these weekly at site and network level:

- Time-to-first-interview and time-to-offer

- Offer acceptance rate and new-hire 90-day retention

- Shop KPIs: first-time fix rate, comeback rate, cycle time

- Plant KPIs: MTBF, MTTR, OEE, quality escapes

- Training ROI: credential count, downtime trend, calibration pass rates

Quick reference: what to do this quarter

- Re-score every open role against the competencies above; update pay bands.

- Lock 2–3 school partners and military/veteran pipelines; co-brand programs.

- Launch a two-step assessment (bench test + structured interview).

- Shorten your hiring SLAs (same-day decisions whenever possible).

- Stand up a training cadence: EV/ADAS or PLC fundamentals based on your mix.

- Publish your safety and career ladder story (site, job posts, social).

- Review metrics weekly; fix bottlenecks in sourcing or selection immediately.

Final word

The U.S. tire and automotive labor market isn’t “tight” everywhere, but it is more technical, more safety-critical, and more candidate-driven than five years ago. Employers who align roles to real competencies, build repeatable pipelines with schools and veterans, and invest in on-the-clock training will win the next decade—on uptime, customer trust, and cost.

If you need help rewriting role profiles, building school partnerships, or standing up a skills-based selection process, TireTalent can bring a shortlist—fast.