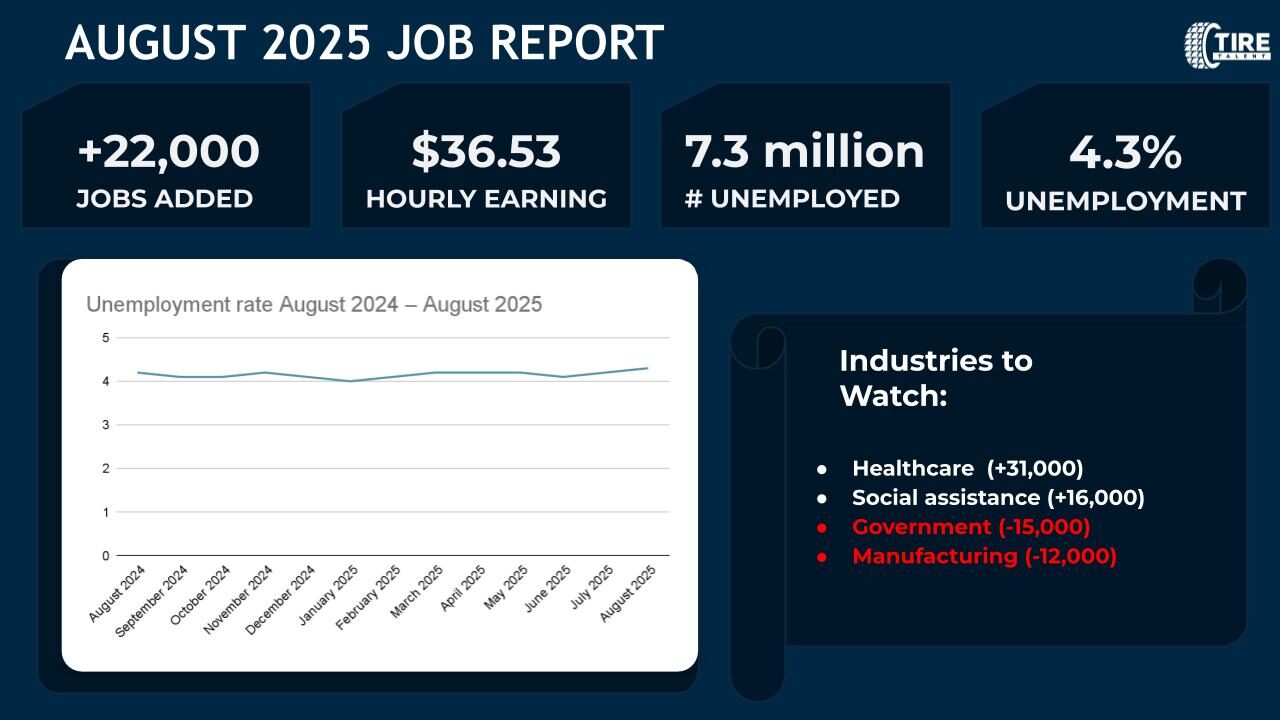

Key Highlights

The May employment report from the U.S. Bureau of Labor Statistics (BLS) shows continued growth in sectors such as healthcare, hospitality, and social assistance. However, declining federal employment and a shrinking labor force suggest that employers and policymakers may be entering a more cautious phase.

Here are some of the highlights:

- The unemployment rate remained at 4.2%, with 7.2 million people unemployed.

- Short-term unemployment (under 5 weeks) increased by 264,000 to 2.5 million, while long-term unemployment dropped by 218,000 to 1.5 million, now accounting for 20.4% of all unemployed individuals.

- The employment-population ratio declined to 59.7% (–0.3 percentage points), and the labor force participation rate dropped to 62.4% (–0.2 percentage points).

- The number of people employed part-time for economic reasons was steady at 4.6 million.

- The number of people not in the labor force but wanting a job held steady at 6.0 million.

Sector Breakdown: Growth in Services, Cuts in Government

May saw job gains concentrated in consumer-facing and care-related industries, while the public sector, particularly the federal government continued to lose jobs.

- Healthcare added 62,000 jobs, surpassing its 12-month average. Growth was led by hospitals (+30,000), ambulatory care services (+29,000), and skilled nursing facilities (+6,000).

- Leisure and hospitality added 48,000 jobs, with 30,000 coming from food services and drinking places.

- Social assistance employment grew by 16,000, driven entirely by individual and family services.

- Federal government employment declined by 22,000, bringing total federal job losses since January to 59,000.

Employment was largely unchanged in other major industries, including construction, manufacturing, retail, transportation, and financial services.

Wages and Hours

- Average hourly earnings rose by 15 cents (0.4%) to $36.24 in May, with annual wage growth at 3.9%.

- Nonsupervisory and production workers saw a 12-cent increase (0.4%) to $31.18.

- The average workweek held steady at 34.3 hours for the third consecutive month. In manufacturing, the average remained at 40.1 hours, with 2.9 hours of overtime.

Revisions: Slower Growth Than Previously Reported

The BLS revised total job gains for the previous two months downward:

- March was revised down from +185,000 to +120,000 (–65,000)

- April was revised from +177,000 to +147,000 (–30,000)

With these changes, March and April job growth is now 95,000 lower than initially reported another signal that labor momentum is decelerating.

Looking Ahead: Cautious Optimism with Mixed Signals

While May’s employment gains reflect ongoing strength in healthcare and hospitality, cooling participation rates and downward revisions suggest a labor market that may be gradually leveling off. At the same time, the steady wage growth and historically low long-term unemployment offer reasons for cautious optimism.

As federal job cuts continue and short-term unemployment ticks upward, employers may need to adjust expectations heading into the second half of the year, keeping a close eye on both labor availability and broader economic conditions.