In the competitive world of automotive service, manufacturing and distribution, building a strong talent pipeline automotive recruiting strategy is more than a nice-to-have it’s a strategic imperative. With the U.S. automotive industry facing evolving technology demands, a shift in workforce expectations, and a strong skills gap, companies in the tire and automotive space must intentionally design pipelines that attract, assess and retain high-quality talent to support production, maintenance and aftermarket growth. This comprehensive guide walks through why a pipeline matters, how to build one specifically for tire and automotive contexts, actionable steps, and data-driven insights so your time invested reading here truly pays off.

Why a Talent Pipeline Matters Now in the Tire & Automotive Industry

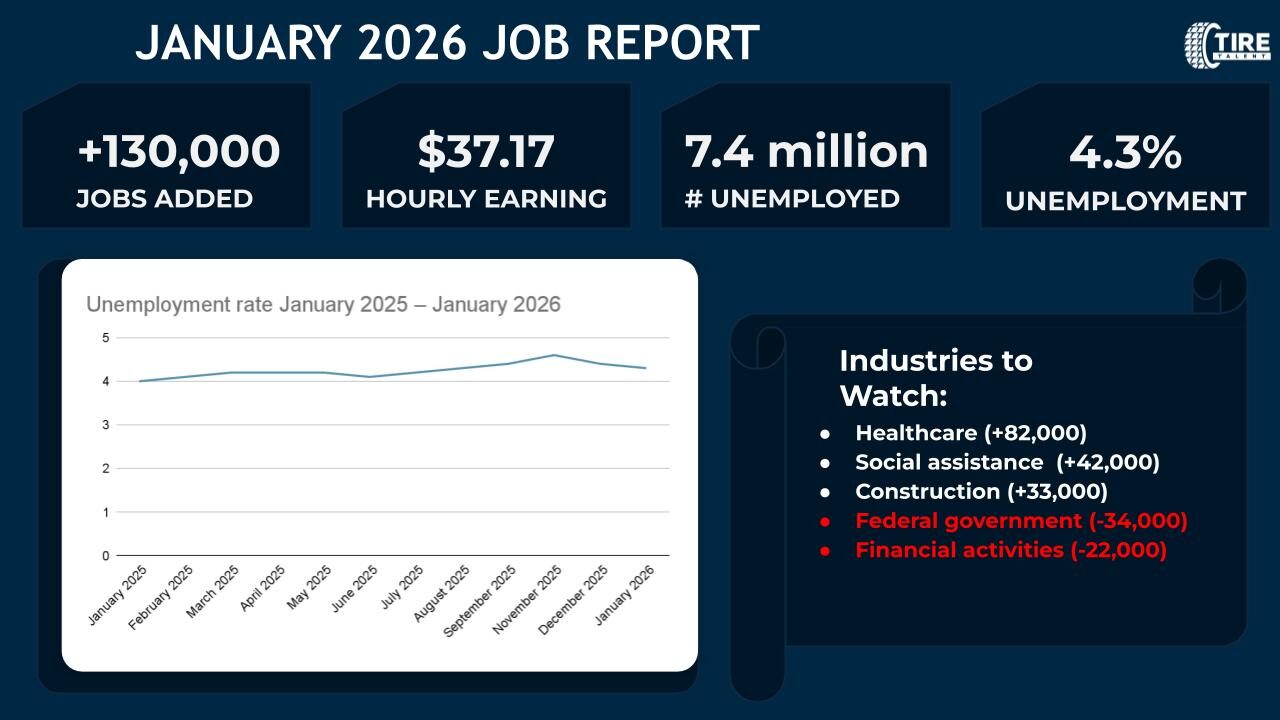

The tire and automotive segment of U.S. industry is undergoing rapid change: electrification, advanced diagnostics, smarter vehicles, supply chain pressures and talent shortages all combine to heighten the risk of being understaffed or mismatched in talent. According to the U.S. Bureau of Labor Statistics, employment in motor vehicles and parts manufacturing declined by around 26.2 thousand between July 2024 and July 2025, and average hourly earnings for production and nonsupervisory workers in that segment stand at $32.53 as of August 2025.

Furthermore, the broader automotive workforce analysis shows the industry is facing a projected global shortfall of skilled workers (e.g., technicians and trades) by 2025 and beyond. ( For example, more than 67,000 technician job openings are projected annually in the U.S. between 2022 and 2032.

For tire-focused companies, which straddle manufacturing, installation/retail, distribution and aftermarket service, the consequences of not having a robust talent pipeline are tangible: slower production lines, missed service appointments, increased overtime, higher training costs, lower quality outcomes and ultimately customer dissatisfaction.

By proactively building a talent pipeline, you:

- Reduce time-to-hire and avoid disruption when roles open.

- Improve quality of hire because you have pre-assessed talent ready.

- Ensure alignment of skills with evolving technology (EVs, diagnostics, smart tyres).

- Lower cost-per-hire by moving from reactive hiring to planned sourcing.

- Enhance retention and culture by showing career pathways and internal growth.

In short: your talent pipeline becomes a competitive advantage, enabling you to stay ahead of talent shortages, skill shifts and operational demands.

Core Elements of a High-Performing Talent Pipeline for Tire & Automotive

A talent pipeline for the tire & automotive industry needs specific design considerations. Here are the key elements:

1. Strategic Workforce Planning & Demand Forecasting

Start by mapping business goals to talent needs. For example:

- Are you expanding tire production capacities, launching new product lines, opening new distribution centres, or increasing service bays?

- What roles will be critical in the next 12-24 months: skilled technicians, installers, diagnostic experts, EV tire specialists, automated manufacturing operators?

- What are current metrics: attrition rate, time-to-fill, cost-per-hire, first-90-day performance?

By modelling demand (e.g., how many technicians needed per shift, growth rate of service bays, new lines in manufacturing), you gain clarity on pipeline volume, timing and skill type. Without this forecasting, you risk hiring reactively and remaining understaffed during peak demand.

2. Candidate Sourcing & Talent Attraction

Effective sourcing for tire & automotive talent means reaching beyond traditional channels.

- Partner with vocational schools, community colleges, technical institutes offering programs in automotive service, electronics, tire mechanics, and diagnostic technologies.

- Develop apprenticeship programmes for installers and service technicians, aligning classroom and on-the-job training.

- Target military veterans and ex-military service members, many of whom have mechanical aptitude and discipline sought in service bays and manufacturing.

- Build your employer brand: highlight technology (smart tyres, advanced diagnostics), training & development, career path into manufacturing/installation leadership, and a strong culture. Given the scarcity of talent, differentiators matter. For example, a 2024 study by Hireology noted that 58% of automotive dealers run hiring processes as fast as two weeks and source quality candidates carefully.

3. Assessment, Screening & Pre-Talent Pool Development

Once you bring candidates in, assessment and screening ensure you maintain pipeline quality.

- Use aptitude and mechanical aptitude tests for roles like installers and manufacturing operators.

- Implement diagnostics and technology assessment for advanced roles: knowledge of EV systems, sensor technology, tyre‐pressure monitoring systems (TPMS), connected vehicle features.

- Develop a “pre-talent pool” of candidates who have been screened, trained or assessed and are ready for hiring when roles open. This reduces lead-time.

- Track pipeline metrics: candidate conversion rate, assessment pass rate, time from screening to offer, drop-off rate.

4. Onboarding & Early Engagement

A pipeline has value only when it converts to successful hires who ramp quickly and stay.

- Create structured onboarding programmes: especially for tire service or manufacturing roles, onboarding should include safety training, equipment orientation, quality standards, team integration.

- Mentorship: pair new hires with experienced technicians or operators. This not only accelerates ramp-up but enhances retention.

- Track ramp-to-productivity metrics: time from hire to full productivity, early performance, retention at 90-days/6-months. Use this data to refine pipeline sourcing & onboarding.

- Communicate career paths: in the tire/automotive industry, many new hires may not see beyond entry roles show them how one can progress into diagnostics, supervisory, manufacturing leadership, or specialty tyre roles (e.g., EV tyre specialist).

5. Retention & Internal Mobility

A talent pipeline isn’t only about hiring it’s about retaining and developing talent.

- Offer continuous training and upskilling: as tyres become smarter, vehicles more connected, roles change train accordingly.

- Promote internal mobility: e.g., move a technician into manufacturing process improvement, or into specialist roles related to smart tyre systems.

- Use employee feedback, engagement surveys, and data to identify potential turnover risk, and intervene early.

- Track retention metrics tied back to pipeline source: which sourcing channels produce hires who stay 12/24 months? Use data to refine pipeline.

6. Metrics & Analytics for Continuous Improvement

Data-driven recruitment is vital to understand pipeline performance and optimise it.

Key metrics to monitor include:

- Pipeline volume vs. hires needed

- Time-to-hire vs. industry benchmark

- Cost-per-hire by role and source

- Quality of hire (first-90-day performance, supervisor rating)

- Retention at 12/24 months

- Source effectiveness: hires by channel, retention by channel

- Conversion rates at each stage: sourcing → screening → offer → hire

For example, as per industry insights, “Recruitment is now heavily influenced by data analytics and predictive hiring models” in automotive recruitment. By applying analytics, you can shift from reactive hiring to proactive pipeline management.

Step-by-Step Implementation Roadmap (12-Month Timeline)

Here’s a practical timeline for your organisation in the tire & automotive space to build a high-performing talent pipeline:

Months 0–1

- Engage stakeholders: HR, operations, manufacturing/service leadership, finance.

- Define business goals, roles needed, skills matrix.

Months 2–3

- Conduct demand & skills gap analysis: what exists internally vs. what is needed.

- Map critical roles, projected volumes, timescales.

- Set baseline recruitment metrics.

Months 4–5

- Develop sourcing strategy: school partnerships, apprenticeship programmes, veteran outreach, employer branding refresh.

- Define assessment workflows and screening tools.

- Build a pre-talent pool database.

Months 6–7

- Launch candidate attraction campaigns, engage pipeline.

- Begin screening and assessments.

- Create onboarding framework for future hires.

Months 8–9

- Hire first cohort from pipeline.

- Initiate structured onboarding and mentorship.

- Track early ramp-up and performance metrics.

Months 10–12

- Monitor retention, ramp-to-productivity, cost-per-hire.

- Review pipeline effectiveness: source conversion, assessment pass rates, drop-offs.

- Adjust sourcing channels, assessment tools, onboarding programmes based on insights.

Communicate internal mobility paths and training programmes to new hires.

Data-Driven Insights & Industry Benchmarks

Here are some relevant data points and benchmarks you can apply in your tire & automotive context:

- According to Hireology, 58% of automotive dealers aim to complete hiring processes within 14 days.

- The BLS reports that average hourly earnings for production and nonsupervisory workers in motor vehicle manufacturing are about $32.53 (August 2025).

- A study by CXC Global shows the automotive sector faces a vacancy rate of 4.3 per 100 employees and a projected global shortage of 2.3 million skilled workers by 2025.

- Skill-based hiring is rising across industries: research shows demand for AI/green jobs increasing while demand for strict degree requirements is declining.

Applying these insights: if you’re aiming to reduce time-to-hire to under 21 days, you can benchmark against the 14-day goal mentioned in dealerships. If your cost-per-hire is high, assess pipeline conversion and source efficiency. If retention at 12 months is low, examine onboarding and career path clarity.

Practical Best Practices & Pitfalls to Avoid

Best Practices

- Early engagement: Building relationships with potential talent before roles open (school partnerships, apprenticeships) ensures a ready pool.

- Skills-based focus: Especially in the automotive/tire segment, emphasize mechanical aptitude, diagnostics, adaptability not just credentials.

- Show career trajectories: Many candidates choose industries where they perceive growth highlight paths from installer to specialist, technician to supervisor.

- Use data and iterate: Regularly review metrics and refine. A pipeline is not “set and forget”.

- Employer brand + candidate experience: The tire/automotive industry competes with tech, manufacturing, logistics make your brand stand out (modern facility, training, clear path).

- Cross-functional collaboration: HR, operations, training, finance must coordinate to build and maintain the pipeline.

Pitfalls to Avoid

- Reactive hiring only: Waiting until you have an open role is too late.

- Ignoring pipeline quality: A large pipeline is useless if conversion and performance are poor.

- Poor onboarding: Without structured onboarding, new hires may ramp slowly or leave early.

- No feedback loop: Without measurement, you won’t know what’s working.

- Underestimating technology/trend shifts: The tire/automotive industry is evolving new technologies require new skills and hiring strategies.

Use Case: Tire Retail Chain Expanding Service Bays

Imagine a national tire retail chain plans to open 50 new service bays in the next 12 months. They estimate needing 150 new service technicians, 50 supervisors, and 20 diagnostics specialists.

- They partner with local technical schools (mechanics/automotive service) to build an early pipeline of students graduating in 6-12 months.

- They launch an apprenticeship programme: 12 weeks of paid training + on-the-job experience.

- They maintain a “pre-qualified pool” of 200 candidates internally screened and assessed, ready when openings arise.

- Onboarding includes 4 weeks of training, mentorship for 90 days, week-1 safety certification, week-2 diagnostics basics, month-2 ride-along.

- They track conversion: from pipeline to hire (70 %), hire to full productivity (average 45 days), retention at 12 months (90 %).

- After 12 months they review: which local schools produced highest retention, which sourcing channels had lowest cost-per-hire, whether supervisors recruited internally progressed into diagnostics roles.

By doing so, they achieve staffing ahead of launch, minimise overtime, maintain service quality, and build a culture of internal mobility.

Conclusion:

Building a high-performing talent pipeline automotive recruiting strategy in the tire & automotive industry is not just HR jargon, it is a business enabler. The time you invest now in aligning talent strategy with business goals, sourcing intentionally, assessing smartly, onboarding firmly and measuring consistently will pay dividends in productivity, cost savings, workforce stability and competitive advantage.

When your pipeline is ready, you’re not scrambling, you’re executing. You’re not waiting for talent to apply, you have talent ready. You’re not compromising on quality because you filled roles fast, you filled them right. For the tire & automotive industry in the U.S., where technology is advancing, skills are shifting and competition for talent is fierce, a robust pipeline is essential.

If you’d like, I can provide downloadable templates tailored for a tire & automotive talent pipeline things like a skills-gap matrix, pre-qualified candidate pool tracker, pipeline dashboard template, and onboarding checklist. Would you like me to set those up?