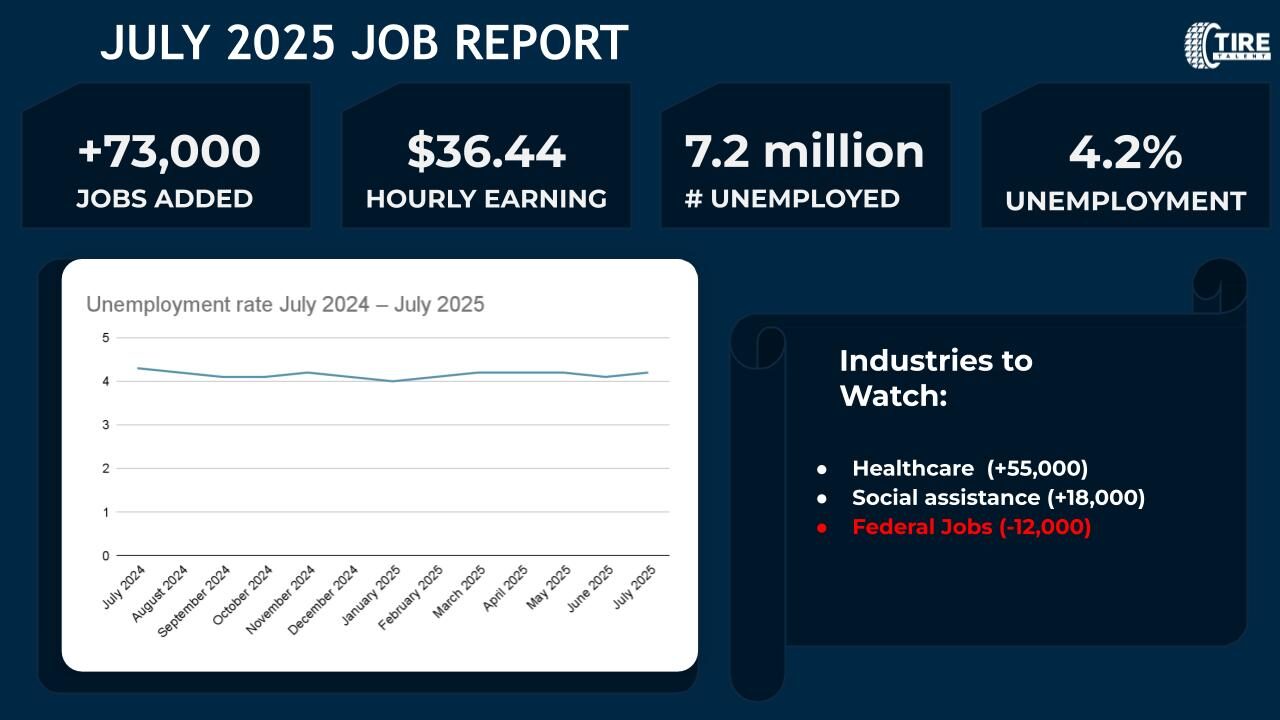

The U.S. economy added just 73,000 jobs in July 2025, continuing a three-month streak of weak hiring. The unemployment rate held at 4.2%, with 7.2 million people unemployed. While sectors like healthcare and social assistance posted moderate gains, the broader labor market showed signs of stalling and downward revisions to May and June payrolls erased a combined 258,000 jobs, painting a more cautious picture.

For the tire industry, these numbers reflect a labor climate defined by caution over expansion. As most major sectors including manufacturing, construction, and transportation remained flat, demand for industrial labor especially skilled technicians, warehouse associates, and production line workers continues to outpace active hiring.

Key Highlights

-

Unemployment held at 4.2%, with 7.2 million jobless individuals.

-

Long-term unemployment rose by 179,000 to 1.8 million (24.9% of total unemployed).

-

Labor force participation was steady at 62.2%, down 0.5 pts year-over-year.

-

Employment-population ratio held at 59.6%, also down 0.4 pts from last year.

-

New job seekers rose by 275,000, suggesting early-career competition is rising.

-

Discouraged workers fell by 212,000, reversing last month’s spike.

Sector Relevance to Tire Industry

-

Manufacturing employment was flat, offering no new tailwinds to tire production facilities.

-

Transportation & warehousing, key downstream partners, also showed no growth.

-

Federal government jobs fell again (–12,000), with 84,000 lost since January, impacting public fleet contracts.

-

Hiring momentum is concentrated in healthcare and social services sectors unrelated to tire market demand.

For tire producers and distributors, this may mean talent remains scarce, particularly for operational and service-based roles. As wage pressures slowly rise, holding onto experienced labor will become increasingly critical.

Wages and Hours

-

Average hourly earnings rose $0.12 (0.3%) to $36.44.

-

Production & nonsupervisory pay climbed $0.08 to $31.34.

-

Workweek increased slightly to 34.3 hours; production workers averaged 33.7 hours.

Revisions: Trendline Softens Significantly

-

May’s job gains revised down from +144,000 to +19,000 (–125,000).

-

June’s revised from +147,000 to +14,000 (–133,000).

-

Net: 258,000 jobs eliminated from prior estimates.

Looking Ahead for the Tire Sector

The tire industry faces a stabilizing yet sluggish hiring environment, where talent shortages persist, but aggressive growth is off the table. With most industrial sectors flat and public sector fleet support contracting, tire employers should focus on internal workforce development, retention strategies, and proactive sourcing for technician-level roles. The back half of 2025 is shaping up to be more about stability than acceleration.