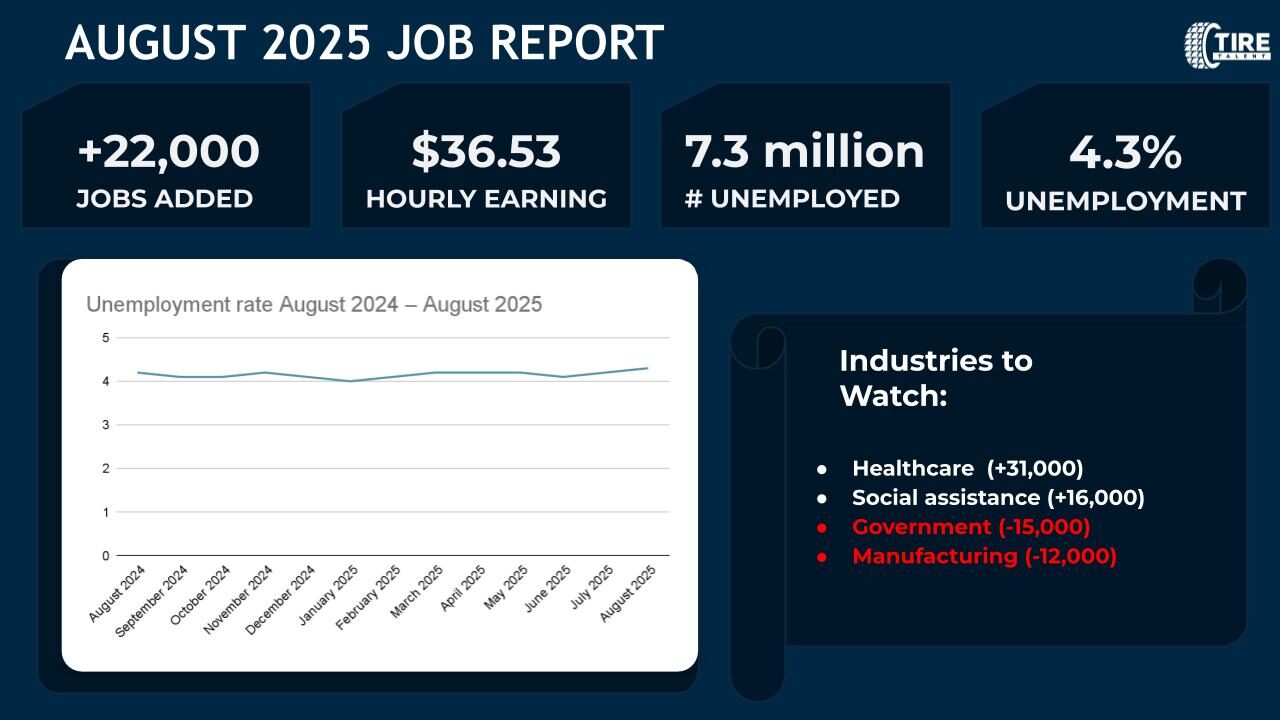

The U.S. labor market showed signs of stagnation in August 2025, with total nonfarm payroll employment barely increasing by 22,000 jobs, while the unemployment rate held steady at 4.3%. Key gains in health care and social assistance were offset by losses in federal government, mining, and manufacturing, signaling potential challenges for workforce planning amid flat growth since April. This subdued performance, coupled with modest wage increases, suggests employers may need to focus on targeted hiring in resilient sectors to navigate ongoing economic uncertainties.

Key Insights – August 2025 BLS Employment Situation Overview

- Unemployment Rate: Remained stable at 4.3%, with little change over the year, indicating a balanced but not expanding job market. This consistency could encourage strategic hiring, as it points to a steady pool of available talent without rapid shifts in labor supply.

- Total Nonfarm Payroll: Increased minimally by 22,000, showing little net change since April and reflecting revisions that lowered prior months’ figures. Businesses should monitor this trend closely, as it may signal broader economic slowdowns affecting recruitment budgets and expansion plans.

- Long-term Unemployed and Part-time Unemployed: Long-term unemployment stayed at 1.9 million, up 385,000 over the year, representing 25.7% of the unemployed; part-time for economic reasons held at 4.7 million. These figures highlight opportunities for employers to tap into experienced workers facing barriers, potentially through flexible full-time roles or upskilling programs to address skill gaps.

- Employment by Industry: Health care led gains with 31,000 jobs, followed by social assistance at 16,000, while federal government (-15,000), mining (-6,000), wholesale trade (-12,000), and manufacturing (-12,000) saw declines. Hiring strategies should prioritize resilient sectors like health care for talent acquisition, while industries like manufacturing may require contingency planning for strikes or downturns.

- Average Hourly Earnings: Rose by 0.3% to $36.53, with a 3.7% increase over the past year, outpacing inflation slightly. This moderate wage growth could support competitive compensation packages to attract talent, but employers in cost-sensitive sectors should balance it against flat productivity.

- Average Workweek: Unchanged at 34.2 hours overall, with manufacturing edging down to 40.0 hours. Stable hours suggest consistent workforce utilization, advising companies to optimize scheduling for efficiency rather than expanding headcount amid slow job growth.

Additional insights for hiring and workforce strategies include a decline in new job entrants and a rise in those wanting work but not actively searching (up 722,000 over the year), pointing to untapped labor pools. With labor force participation dipping to 62.3%, proactive outreach and inclusive recruitment could help fill roles in growing areas like health care, mitigating risks from sector-specific declines.